estate tax exemption 2022 build back better

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. For 2022 the personal federal estate tax exemption amount is 1206 million.

Latest Update On The Build Back Better Act For Estate Planners Wealth Management

A reduction in the federal estate tax.

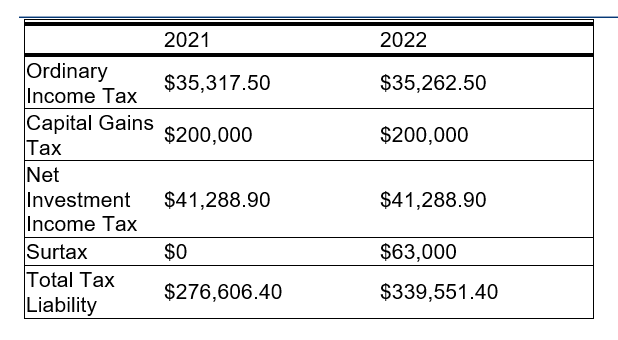

. The Estate Tax Exemption and Current Build Back Better Legislation Headlines indicate President Biden will be signing the Infrastructure Investment and Jobs Act on Monday. Instead it contains three primary changes affecting estate and gift taxes. For 2022 the gift estate and GST tax rate remains at a flat 40 for taxable transfers that exceed the transferors available exemption.

The federal estate tax exemption is currently set at 10 million and is indexed for inflation. Bernie Sanders I-Vt speaks with reporters in the Senate subway on. There will be no lowering of the estate tax exemption in 2022.

The Estate Tax Exemption and Current. Gift and Estate Taxes Proposed Under the Build Back Better Act. This was anticipated to drop to 5 million adjusted for inflation as of January 1.

The exclusion amount is for 2022 is 1206. This is certainly cause for celebration. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption.

Estate Taxes One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022. Understanding Other Proposed Changes Under the Build Back.

The BBBA proposes to reduce the federal estate and gift tax exemption from the current 117 million per individual to 5 million per individual indexed for inflation. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. If the ballot measure were already in force sales of these two types of real estate would have raised about 690 million while sales of expensive single-family homes would.

This means that when someone dies and the. The exempt increased from 117 million for 2021. The BBBA proposal seeks to reduce these.

Lowering the gift and estate tax exemptions seems a lock. If your spouse is not a citizen of the. The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles.

As the draft now stands the legislative proposal may restrict the abilities of higher net worth individuals to shelter assets from tax consequences in their estate planning. As far as we know as of today. The hypocrisy of Democrats Build Back Better bill giving the rich a colossal tax cut.

Gift and Estate Taxes Proposed Under the Build Back Better Act. A reduction in the federal estate tax exemption amount which is currently 11700000. The estate tax exemption is a whopping 2412 million per couple in.

Tax provisions in the build back better act coordinated by molly f.

Richard Neal Says Biden Inheritance Tax Plan Is Short Of House Votes Bloomberg

House Gives Billionaires A Pass With New Nicotine Tax

Tax Reform Bill How Does It Impact You Ramseysolutions Com

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Senate Releases Build Back Better Act Tax Changes As Progress Slows Our Insights Plante Moran

Tax Proposals Under The Build Back Better Act Version 2 0

Analyzing Biden S New American Families Plan Tax Proposal

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra

Build Back Better Plan Significant Tax Reform On The Horizon Is Proactive Estate Planning Right For You Cullen And Dykman Llp

How The Build Back Better Plan Will Increase Estate Taxes And More Youtube

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Inflation Reduction Act Of 2022 New Corporate Book Minimum Tax And Changes For Carried Interests Shearman Sterling

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

More Families Can Now Take Advantage Of A 24 12 Million Portable Estate Tax Exemption Waller Lansden Dortch Davis Llp Jdsupra

Tax Reform For Small Businesses Nfib

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Proposed Build Back Better Act Contains Key Tax Provisions Our Insights Plante Moran

Tax Strategy Year End Planning Amid Tax Uncertainty Accounting Today